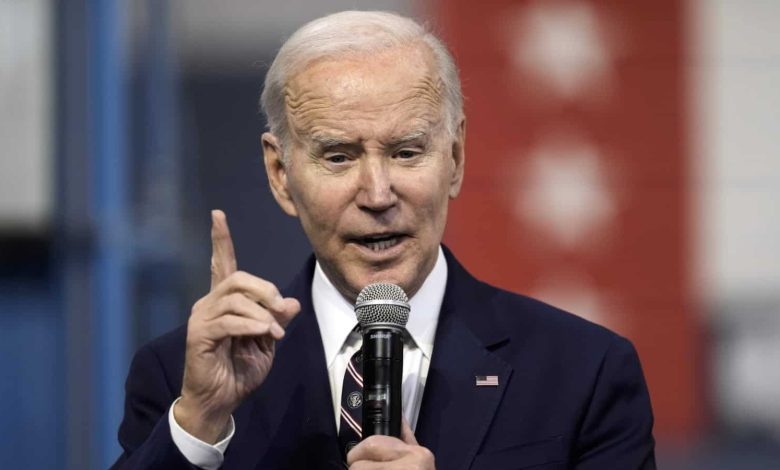

‘…for this mess’: Joe Biden reacts as Signature Bank is closed after the failure of SVB | World news

US President Joe Biden on Sunday vowed to hold “fully accountable” the people responsible for the failure of Silicon Valley Bank and the second financial institution, Signature Bank. He, however, sought to assure Americans that their deposits were safe.

“I am firmly committed to holding those responsible for this mess fully accountable and to continuing our efforts to strengthen oversight and regulation of the big banks so we don’t get into this situation again,” Biden said in a statement.

“The American people and American businesses can trust that their bank deposits will be there when they need them,” the president added.

Biden said he plans to speak about the US banking system on Monday morning, to reassure Americans after the failures of Silicon Valley Bank and Signature Bank.

“I will make comments on how we can maintain a resilient banking system to protect our historic economic recovery,” he said Sunday night in a statement that also included Biden’s promise to “hold those who he is fully responsible for this mess.”

In a joint statement, the financial institutions, including the US Treasury, said that SVB depositors will have access to “all their money” starting on Monday, March 13.

The “main objective” of the transfers is to assure the bank’s customers that they will have their money “to meet the salary to keep their businesses running, and to ensure that families are able to pay the rent or mortgage or any of their other currencies,” US Federal Reserve officials told reporters on Sunday night.

The Fed announced that it will provide additional funding to banks to help them meet the needs of depositors, which will include withdrawals.

“We are taking decisive actions to protect the U.S. economy by strengthening public trust in our banking system,” the companies said.

Why did US regulators close Signature Bank?

Signature Bank, an FDIC-insured New York state commercial bank, had total assets of about $110.36 billion and total deposits of roughly $88.59 billion as of Dec. 31, the New York Department of Financial Services said. in a separate statement.

Signature Bank representatives did not immediately respond to a request for comment.

Silicon Valley Bank unexpectedly became the largest US lender to fail in more than a decade on Friday, filing for bankruptcy less than 48 hours after outlining a plan to raise capital. The bank took a huge loss on the sale of its securities amid rising interest rates, spooking investors and investors who quickly started withdrawing their money. On Thursday alone, investors and investors tried to yank about $42 billion.

US regulators are racing against the clock to find solutions for the failed Silicon Valley Bank and stop a potential spillover from spreading to other lenders.

(With inputs from AFP, Reuters, Bloomberg)